I was recently on the Investor Mama podcast to talk about easy ways to coach your kids through money and business topics in a fun way.

I shared seven conversation starters, and each takes just five minutes or less. You can easily start one of these conversations in the car, at bedtime, at bathtime, in the doctor’s office waiting room, or even sitting around the dinner table.

I recommend starting when your kids are in elementary school, but the great news is that these conversations apply to middle schoolers and high schoolers, too.

Before starting these conversations, I’d encourage you to read your kids some picture books on these topics. The Money Smart Kids series is a great place to start to help get their wheels turning about what it could look like to start their own business – as a kid!

To hear our full podcast conversation, with in-depth examples for each question, listen here (link coming soon).

Remember, these are just a starting place to learn and grow, no wrong answers!

Seven Questions to Get Your Kids Thinking Like an Entrepreneur:

- Ask–If you had your own money, what would you buy?

This question creates immediate engagement and helps kids value what comes next. They could brainstorm a list and then pick their Top Three.

You could even help them estimate how much they would have to earn to buy their Top Three items.

This is also a great time to plant the seed about giving.

What type of charity would they want to give to? It can be a fun way to reveal what moves the heart of your child.

Then – get into questions about creating a business (questions 2-7)

2. Ask – If you were to start a business, what product or service would you sell?

Here you can discuss…

… products vs. services

… your child’s unique skill set and strengths (they will love hearing from you, and it’s fun to hear what they think their own best skills are)

…what could they make better? A special kind of roller skate, folding laundry, a service for kids to deliver snacks! All ideas are welcome.

3. Ask – Where would you sell XYZ?

Let them brainstorm locations– school, park, local craft faire, door-to-door. Then make sure to dive into the pros and cons of each (traffic, visibility, safety, cost, fun factor).

4. Ask – How would you let people know about what you are selling?

When I was in college I read something along these lines:

Selling without advertising is like a man winking at a woman in the dark, he knows what he’s doing, but she doesn’t have a clue!

Make it easy, give people a clue!

So how will your kids be bold and get the word out about their business?

Sign, flyers, talking to people 1:1, website, business cards, email, a short video text to family and friends…

Challenge your kids – how will you make your message short and exciting so that people will want to use your service or buy your product?

5. Ask – How much would you sell it for?

If your kids are younger, you may have to help with this one.

Have them think about how much their supplies will cost – for the product and advertising.

Then have them think about how much they want to make each time their product sells. Now add those two numbers together to get the price you will charge.

Example: $1 total in supplies and advertising, and I want to make $5 per item after expenses, so I need to sell each one for $6.

Have them wrap up with a gut-check:

Is that price reasonable for the item I’m selling?

Would I pay that much if I saw this item for sale?

6. Ask – If your product wasn’t selling, what would you do?

Ideas: Could change the location you sell it.

You could change the advertising message: What words and description would make the item more likely to sell? Handmade, one-of-a-kind, will solve XYZ problem.

Or do they need to keep pitching and then adapt their product based on feedback?

In the book How to Sell a Rock, all the neighbors say no – but Sebastian keeps adapting his product and message until he finds what his customers really want.

7. Ask – How will you make sure you have money left to buy more supplies?

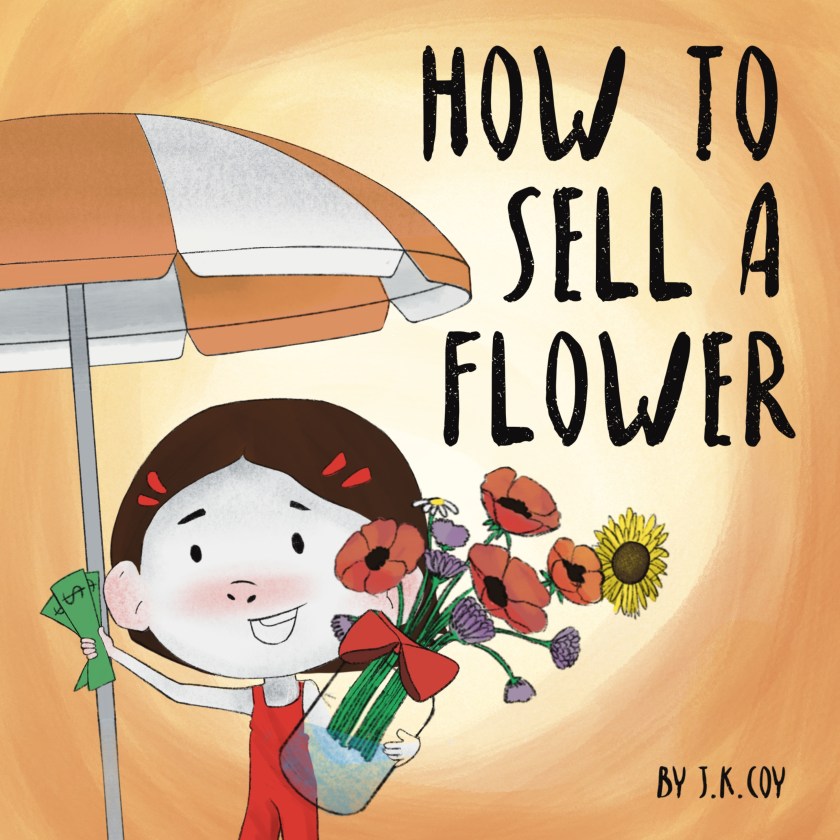

You can help them break their money into three buckets like Sophia did in the book How to Sell a Flower.

She used the three S’s for the money she earned from her business:

Supplies (short-term expenses)

Save (long-term expenses)

Spend (pay yourself and get some of the things you want + need for you)

Helping your kids have this responsible money mindset early on will help make sure they can stay in business and keep earning their own money!

One Final Ask:

Support these entrepreneur kids when you see them.

I once had two neighbor girls come to my door asking to walk my dog.

My dog is kind of a punk, so I didn’t want to put them in that situation. However, I saw their desire to make money, and I hired them to be mother’s helpers for the summer to entertain my girls while I worked from home. We all won!

Gives these kids the gift of practice: Engage in conversation, Give them at-bats to practice, let them work out the kinks, and then let them earn the money!